London, United Kingdom

CRBN.credit has launched an institutional carbon market intelligence platform aimed at improving transparency, pricing analysis, and regulatory understanding across global carbon markets. The platform is designed to support professional users navigating compliance regimes such as the EU Emissions Trading System (EU ETS), Carbon Border Adjustment Mechanism (CBAM), and voluntary carbon markets.

The launch comes as carbon markets face increasing scrutiny from regulators, investors, and corporations, alongside growing demand for higher-quality data and more consistent analytical frameworks. Market participants have long cited fragmented data sources and inconsistent methodologies as barriers to effective decision-making in carbon markets.

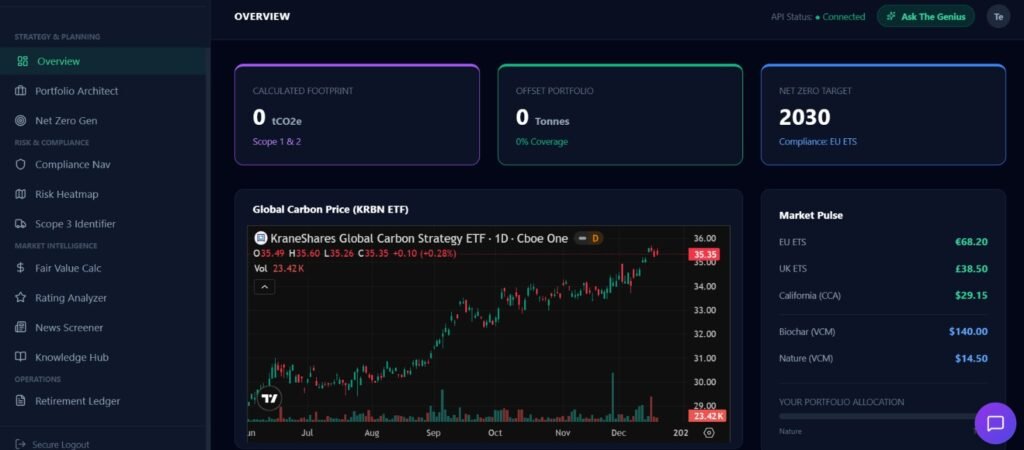

CRBN.credit brings together market analysis, carbon price forecasting, regulatory context, and AI-assisted strategy tools within a single platform. Rather than operating as a transactional marketplace, the system focuses on intelligence and research, offering users tools to assess market structure, price signals, credit quality, and long-term regulatory trends.

The platform includes publicly accessible research and tools, alongside a private client dashboard that provides advanced analytical features. According to the company, the dashboard is designed for internal use by institutions, advisory firms, and research teams that require audit-ready outputs and structured analysis.

CRBN.credit was developed as a founder-led initiative and is currently operating in beta. The platform’s architecture supports private deployments and potential white-label integrations, reflecting a focus on institutional adoption rather than mass-market usage.

Founder Background

CRBN.credit was founded by Souptik Guha Roy, a product-focused technologist and independent builder with experience developing data-driven platforms for professional and institutional use. Roy has previously designed and delivered enterprise-grade software systems that are currently used by organizations and agencies in Europe and India.

With a background spanning software building, vibe coding, market research, and financial analysis, Roy built CRBN.credit to address structural gaps in carbon market intelligence. The platform was developed over several months with an emphasis on research depth, system durability, and institutional workflows rather than early commercialization.

Roy stated that the objective behind the platform is to create “a durable intelligence layer for carbon markets that supports pricing clarity, regulatory awareness, and long-term strategic decision-making.”

Market Context

Carbon markets are undergoing structural change as compliance mechanisms tighten and demand grows for high-integrity credits. Regulators in Europe and other jurisdictions are increasing oversight, while corporate buyers and investors seek greater confidence in pricing, quality, and long-term market signals.

CRBN.credit positions itself as an analytical platform aligned with these developments, focusing on research depth and institutional workflows rather than rapid commercialization.

More information is available at https://crbn.credit

About CRBN.credit

CRBN.credit is an institutional carbon market intelligence platform focused on pricing analysis, regulatory context, and strategic research across compliance and voluntary carbon markets. The platform combines data analysis and AI-assisted tools to support professional decision-making.